I’m celebrating zero this week. I’ve just finished the process of publishing my first ebook (Trojan Moments: Experiences that Ambush). It has zero sales (sounds like a weird thing to celebrate, but I will explain) and zero costs (obvious win there). It’s a poetry collection, so there was never much expectation that it would be big, but celebrating zero? Come on, that’s pathetic.

I’m celebrating zero this week. I’ve just finished the process of publishing my first ebook (Trojan Moments: Experiences that Ambush). It has zero sales (sounds like a weird thing to celebrate, but I will explain) and zero costs (obvious win there). It’s a poetry collection, so there was never much expectation that it would be big, but celebrating zero? Come on, that’s pathetic.

Why I’m celebrating zero sales

Like a lot of people, I procrastinate, I get depressed, I work a day job. Life happens, and the months and years really roll by. Sometimes I doubt my creativity and I don’t always finish my projects. I’ve been wanting to get this book out in this format since 25 May 2006.

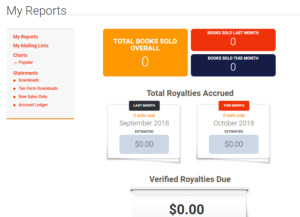

Yeah, you read right, more than ten years. It was first published that Thursday in paperback (a whole other story). In the decade since then I’ve fought a lot of demons and ghosts, but the desire to finish that job wouldn’t die. So yes, I’m embarrassed that it took twelve years, five months, and five days to put a tick in the box but here’s the thing, I did do it. You only get a sales dashboard when you have something to sell, something finished and listed, ready to download.

That’s what that big chunky zero means to me – success. A milestone that haunted and mocked me for over a decade is finally tamed. It sounds so easy, it is such a short sentence ‘publish an ebook’. Three little words, and I’d already written the book!

What it takes to get to zero

You might be curious about what it takes to fulfil that three-word task. Here are some of the tasks it involved:

- Edit and revise the existing text

- Create new content (reading group material and a quirky summary of the inspiration)

- Reformat the revised text in MS Word and then in Scrivener and then in Word and then in Scrivener until I finally had it right

- Redo the cover, make new covers, test out covers, get contradictory feedback, nearly toss the whole thing out because the cover issue was so painful, remembered this is a hobby and meant to be fun, went back to the original design and moved on with my life.

- Research the current ebook market and decide on a marketing strategy for the book (quite a similar emotional process to that outlined for the cover)

- With the strategy “nailed down” (ha!) I researched options for publishing, including evaluating the costs, time and services available and if it would be possible for me to DIY (and how long that might take me)

- Because I decided to “go wide” (ie publish on more than Kindle Select) I chose an aggregator that would take a single file and publish it to multiple platforms on my behalf. They take a cut of my royalties for this.

*whew*

The file formatted, I went ahead and clicked on that little grey ‘submit’ button. And … nothing happened. Two days later I got an email saying the file was rejected. I fixed that one metadata field and reloaded, resubmit. This time, happy little green notifications started popping up within an hour and it was underway. It took a full week to appear on Amazon (and with the wrong price!) but finally, after years and a learning curve like The Wall, I was here, celebrating zero. Happy dance ensued.

A zero full of potential

Celebrating that zero makes perfect sense when you know a bit of the story to getting there. It is a private pleasure. To the rest of the world it is “so what?” but to any indie published author that first book is a stack of achievements and the zero symbolises accomplishment and a transition into the next level.

Just as with the zero card in tarot (usually The Fool) it heralds the inception of a new beginning. With this act of stepping off my known path and into the unknown future there is potential for the rest of my dreams to begin to come to life too. The nature of the moment is ephemeral. In another week or month that zero may begin to feel like a judgement. One hopes it doesn’t outstay it’s welcome. All it will take to turn that zero into profit (the other key success measure in sales) is just one sale.

When zero turns to one

Everything changes when you can say “Yes I have made money selling my books.” I did that in 2006, hand-selling a poetry book (bless every one of you and thank you) and I will do it again this year.

Want to know my secret? Realistic expectations and zero costs.

Poetry is not hugely popular (unless you’re lovelorn on Instagram) and up until recently few people would admit to it at all. Honestly, you’d think it was the ninth deadly vice or something, but I digress. Realistically, I knew it would be hard to sell copies.

I knew that I couldn’t count on high (or possibly even double-digit) sales in the first three months. But I did want this publication to break even quickly so it could hold it’s head high on my (eventual) backlist. Knowing that made it easy for me to select an approach and services that would keep my costs down.

In the end it cost me nothing to publish the ebook internationally (Here are my costs – pdf ). I’ve listed it at $0.99 and at that price I need to make one sale to make a profit. One sale. Sure, the profit is as low as 29c but hey, the numbers don’t lie and that is cold hard digits into my PayPal account (90 days later). Boom.

Not everyone can love a zero

It takes an author to be excited at the prospect of making 29c but that’s how this game plays for little fish like me. There are shoals of sharks ready to tear thousands of dollars out of you if you don’t know how to navigate these waters. You may not believe it, but publishing is a ruthless industry. It isn’t all cups of tea, overdue library notices and polite book clubs. I hope you’ve enjoyed this foray into some of what it took to publish this book and can join me in celebrating zero.

Why not splash out and buy a copy? Trojan Moments is on sale at the celebratory price of 99c in your favourite ebook store during October 2018. But you know, totally cool if you’re not into it.

In my past, I’ve been through the experience of some

In my past, I’ve been through the experience of some